Not everything that shines is a diamond

In general, luxury sector is considered to be resilient to economic cycles and this perception largely stands up to scrutiny based on historical data. The secret to this resilience lies within the target audience, which consists of high-net-worth individuals who possess the financial means to maintain their consumption habits regardless of economic situation. These consumers continue to invest in high-value items, such as rare watches, leather bags and jewelry, which are often perceived as appreciating assets. At least, this is the general narrative circulating within the masses and given market volatility and current economic uncertainties, topicality of luxury space has never been more relevant. But not all luxury is created equal and not every high-end brand is a good long-term investment despite the prevailing perception. So how do you differentiate and bet on the right horse?

Fool’s gold or why Quality matters

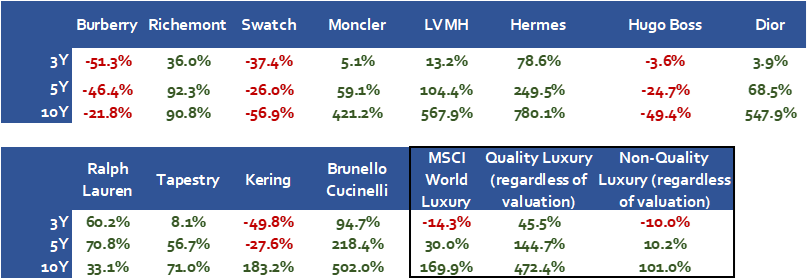

In SP 500 and Stoxx 600 indices combined, there are twelve companies that can be classified as high-end within Consumer Durables Apparel group. Quite naturally, USA, being a younger country, lacks deep-rooted legacy in luxury goods; therefore, it is represented by just two companies: Ralph Lauren and Tapestry, owner of Coach and Kate Spade brands. If we look at the returns of these companies over last 10 years, it becomes clear that the space is anything but homogeneous when it comes to the performance. In fact, the gap between outperformers and underperformers is so big that it is jaw dropping (Figure 1). One common trait that unites winners and losers is quite straightforward: quality of the business model or absence of such. Over the last ten years, average Total Return of Quality luxury companies – as defined by selection methodology of Hérens Quality AM (in this analysis and in contrast to portfolio companies, only fundamental quality was considered, without valuation) – was 472%. This compares to 170% gain in MSCI World Luxury Durables and Apparel Index and mere 101% performance of Non-Quality luxury companies included in the abovementioned universes.

Figure 1: Total Return as of 30.06.2024 (EUR)

It would be, therefore, fair to ask if there are any common characteristics that quality and non-quality companies within the space share. And there indeed are. The first two are of equal importance and are closely intertwined – brand positioning and market positioning. When it comes to brand positioning, uncompromised integrity that spans across decades is something that all quality luxury companies share. And regardless of them being soft or hard luxury, the aura they created around those brands is also very similar – that of heritage, timelessness, “old money”, exclusivity. One company that absolutely nailed this game is maker of Birkin bags, French luxury maison Hermès. Over the years, their strategy has been so consistent, so unyielding to the new trends in the industry, that it sounds almost boring. Yet perhaps this is exactly why Hermès is an outlier even for quality luxury space – the resilience with which they navigate through economic cycles, headwinds and various force majeure situations is simply remarkable.

And then on the other side of the spectrum there are brands that failed at preserving their core identity – Burberry, Hugo Boss, Gucci (owned by Kering). Their downfall happened at different times and because of different underlying strategic reasons, but in the end, they were brought down by the same thing – misalignment of the brand and loss of clear identity in the eyes of consumers. In most of the instances it happened because ambition for growth was so strong that it downplayed the risk of diversion from the core. But to be fair, from market positioning perspective, it is easier for luxury fashion brands to lose their way than it is for ultra-luxury ones, unless latter purposefully decides to become “trendy” to broader market reach.

But this increased accessibility can dilute the perception of exclusivity that is crucial for maintaining a luxury image. Luxury fashion brands also rely heavily on seasonal trends and designer-driven aesthetics in the attempt to keep up with rapid changes in consumer preferences and remain relevant. The perfect example of how that strategy screwed up the brand is Gucci and Balenciaga, both of which belong to Kering SpA. Both have experienced phenomenon of going viral, which massively increased brand visibility and appealed to younger Gen-Z. In H1 2018, when “Gucci Gang” effect reached its peak, 55% of Gucci’s sales were made to consumers under 35, and the brand’s sales nearly doubled during this period. However, as the maximalist, logo-centric designs that screamed of luxury fell out of fashion, Gucci struggled to adapt quickly enough, which led to slump in sales and market share loss.

Ultra-luxury brands, on the other hand, maintain a higher level of exclusivity by limiting production and distribution, which helps preserve their allure. They mostly focus on timeless designs and quality craftsmanship, which are less susceptible to fleeting fashion trends.

High Net Worth Individuals versus aspirational middle class

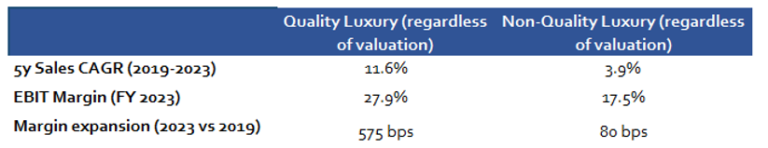

Another common denominator among Quality luxury names is that although they also find aspirational customers important for long-term expansion of customer base, their core target audience remains high net wort individuals or NHWIs. This is an important distinction as HNWIs have significantly greater financial resources and spending power compared to aspirational customers. As a result, they tend to be less price-sensitive and more focused on quality and exclusivity. This is why ultra-luxury brands primarily serve the top 2% of luxury consumers who drive 40% of luxury sales. These ultra-wealthy customers are less affected by economic downturns and fashion shifts, providing more stable demand. Therefore, it should not be of a surprise that this stability is well reflected in operational performance of Quality luxury companies. As Figure 2 shows, average compounded sales growth of Quality luxury stocks over the last five fiscal years has been in low double-digits, while that of Non-Quality has only been 3.9%. Remarkably, Quality luxury has seen just one year of negative sales growth over 2014-2023 period, while median for the non-quality cluster was four years.

Figure 2: Average characteristics of Quality and Non-Quality luxury companies

China – a tale of two cities

When it comes to the luxury space, this year all eyes are on China. And this should not come as a surprise, even though contributions of Chinese customers to the global luxury sales have shrunk as compared to the pre-pandemic levels (from 35% in 2019 to 22-24% in 2023 according to Bain Company), country remains the key market for luxury. Decline in consumer sentiment among middle and high-income individuals, downbeat economic growth, and real-estate crisis – combined, these factors created force strong enough to reduce appetite for luxury among Chinese clientele. Besides, many are taking advantage of a weak yen by flocking to Japan and latest reporting season showed just how eager are Chinese shoppers to seize this opportunity, with Cie Financière Richemont and LVMH, for example, reporting more than 50% growth in local currencies in the country.

But existing headwinds in China are not affecting all luxury companies in the same manner. Moncler, Hermès, Prada have proven to do well despite softness in the country, while others, such as Kering, Burberry and Hugo Boss are struggling so much that it forced them to slash outlook for the entire year. When the quality of the brand is intact, when the core remains strong, it is much easier to navigate the treacherous waters, be it China or any other market for that matter. Therefore, true quality luxury names do exactly what is expected of them – they show resilience and shine, both operationally, and return-wise.

ADVERTISEMENT

This document has been prepared solely for information and advertising purposes and does not constitute a solicitation offer or recommendation to buy or sell any investment product or to engage in any other transactions.