2025 Review

Is Quality style in trouble?

Triumph of momentum and non-quality

What a bumpy year! Tariffs, AI frenzy, military conflicts across the globe, and political interventions into business affairs created extreme uncertainty at every level—countries, business models, and sectors—in 2025. Quality stocks, which traditionally serve as a safe harbor, struggled to provide protection in this environment. While sitting on the sidelines, they continued to deliver strong earnings growth, market share gains, and high profitability, yet the market largely ignored these fundamentals.

The software sector was particularly hard hit. Historically one of the highest-quality segments—with nearly 100% recurring revenues, extremely high profitability, asset-light business models, and robust balance sheets—it underperformed amid the market upheaval. Meanwhile, the top-performing stocks were those directly exposed to uncertainty and changing global trends: AI-related companies, defense, and financials. Most high performers came from the non-quality segment. While some quality stocks did benefit from the AI rally (e.g., Nvidia and Arista), others with weaker financial quality (e.g., Broadcom, Oracle, AMD, Seagate) dominated attention.

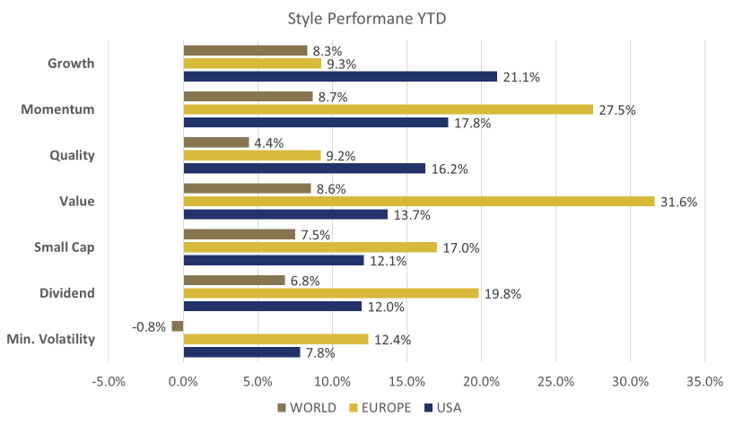

In Europe, quality investing experienced its worst year since 1990s, substantially lagging Value and Momentum strategies: 9.2% vs. 32% and 27.5% respectively. In the U.S., where appetite for AI risk was heightened, Quality lagged behind Growth and Momentum but outperformed more conservative strategies, such as Dividend, Minimum Volatility, and Value stocks.

Notably, the MSCI World Quality index in EUR barely crossed 0%, showing that even AI tailwinds could not generate high returns. Currency movements further weighed on European investors, as the USD declined sharply against the EUR and CHF—a pace not seen in several years, as interest rates in US trended downward.

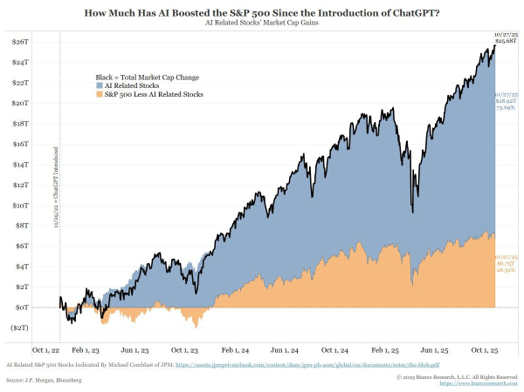

Overall, capital became highly concentrated in a narrow group of perceived future winners (Fig. 2), driving expectations and valuations to levels with very little margin for error. This environment left many high-quality businesses temporarily overlooked, creating an opportunity for quality investors.

Fig.1 Total return for 2025 by regions based on MSCI regional indices (Currencies: USA – in USD, EU – in EUR, World – in EUR); 1: Gesamtrendite 2025 nach Regionen basierend auf MSCI-Regionalindizes (Währungen: USA – in USD, Europa – in EUR, Welt – in EUR)

Fig.2 Market cap gains of AI Related stocks vs. S&P 500 less AI related stocks since ChatGPT launch in October 2022;

You can access the entire annual report via the link below.

ADVERTISING

This article has been prepared solely for information and advertising purposes and constitutes neither a solicitation nor an offer or recommendation to buy or sell any investment instruments or to engage in any other transactions.