LOOSE MONETARY POLICY MADE THE YEAR FOR INVESTORS

Market growth was supported by favorable central bank positions across the world

Fig.1 2019 Total return by regions and styles

Regionale, Style und Size Indices von MSCI (Ausnahme regionale

Performance Schweiz: SPI Index) (Gross TR), USA – in USD, EU – in EUR, CH

– in CHF, World – in EUR, EM – in USD);

* – Hérens Quality Composite; Source: Herens Quality AM, Reuters, MSCI

Recall the mood prevailing on the stock market a slightly over a year ago: broad-based depression and fear after heavy sell-off of stocks and piling challenges ahead such as Brexit, trade tension, subdued capital spending, political uncertainty and global economic slowdown. But none of that mattered as soon as US Fed radically changed its monetary policy rhetoric, switched from rate hikes to rate cuts and injected liquidity to the market. Other central banks also eased their monetary policies and signaled they would probably leave their policy rates at a low level for an extended period of time. In September, ECB cut its deposit rate to a record low of -0.5% from -0.4% before and said it will restart bond purchases in the amount of EUR 20 billion a month starting November as a reactionary measure to the sharp economic slowdown in first three quarters of 2019. SNB, however, despite mounting pressure to follow global counterparts, kept its policy rate and interest on sight deposits at −0.75% during its last meeting in December. The efforts of central banks were not in vain – markets responded with the stellar performance, breaking old records and reaching new highs. The only unloved child on this party was the emerging markets, where investors saw elevated risks because of geopolitical tensions and trade war that was causing slowdown in Chinese economy. Large growth companies became the main locomotive in delivering excellent performance in virtually all global stock markets. Performance of growth style was primarily fueled by the IT sector, which was the top performer, to a great extent helped by the ecosystem stocks such as Apple, which gained 85%, and Microsoft with 54%, together accounting for 15% of the broad market gains. Also industrials returned decent figures after troublesome performance in 2018. Value continued losing to Growth and the trend most probably is set to go on unless economic paradigm changes (see our article on growth vs. value style – link). Quality style, having a certain bias to the IT sector, delivered strong results too. We saw Quality in the lead versus the benchmark and versus other investment styles. We strongly believe that Mr. Market recognizes companies with competitive products and good management now more than ever, which should translate into sustainable good performance also in the future.

PORTFOLIO INVESTMENT DECISIONS

Straumann (BUY)

Good things come to those who wait. Sometimes it might take months and even years for one to seize the desired opportunity, but patience can be rewarding. Like a croc in the ambush one has to wait at water edges for the buffalo to finally come for the drinking water. In our story, we were the predators and Straumann was our prey. Swiss dental implant maker is one of those remarkable companies that have courage to expand its borders despite widespread skepticism. When in 2012 Straumann acquired 49% stake in Brazilian Neodent (which later was brought to full ownership), it was considered as bluntly bold and risky move – never before in a dental implant world a premium brand and a value brand resided under one roof as premium players were always afraid of the brand cannibalization on behalf of the cheaper products. But Straumann knew that if they wanted to unlock significant growth opportunities, proceeding with right pricing, right product and right strategy, the cannibalization could have been avoided. For legacy competitors, consequences of this move were daunting – since 2015, Straumann was adding roughly a percentage per annum to its already dominant market share, while those of the peers remained stagnant. Company’s chase for additional opportunities did not stop just there. Over the years, through expansion into adjacent spaces, like clear aligners among others, Straumann transformed itself from a simple dental implant manufacturer into a complete solution provider for aesthetic dentistry, increasing the size of the addressable market fourfold. As a result, Q3’19 marked 18th (!!!) consecutive quarter of double digit growth. Needless to say that such stellar performance was well reflected in the share price appreciation and while quality of the company was never in question, valuation was remarkably demanding. So, we watched and waited for the good entry point. And in September 2019, when temporary pull-back occurred, it appeared. In less than three months in Swiss portfolio, Straumann gained 17.6% and outperformed broader Swiss market by 12.8%. The hunting season was a success.

Mowi (BUY)

Nothing makes a fish bigger than almost being caught. However, when making an investment decision, uncertainty is minimized and the opinion is based on facts. That’s why we highly value sustainable and transparent business models. This summer we added one more such type company to our European portfolio – world’s largest producer of farmed salmon from Norway. Salmon fish farming started on an experimental level in the 1960s, but became huge industry in Norway in the 1980s, and in Chile in the 1990s. The farmed salmon industry has grown substantially in the past decades and today approximately 70% of the world’s salmon production is farmed. Underpinned by changing consumer trends, new product innovation and sophisticated farming systems, salmon has risen to become one of the world’s most popular seafood products. With the lowest carbon footprint, lowest feed conversion ratio and lowest land use, farmed salmon is also one of the most eco-efficient forms of animal protein, according to the Global Salmon Initiative. In such market conditions, it is no surprise that business is thriving and, we believe, Mowi is the strongest player among all, as it benefits greatly from its vertical integration. By integrating the entire value chain, it can control its products from feed to fork and be more proactive in addressing challenges related to sustainable feed, breeding and genetics, farming and secondary processing. Mowi farms Atlantic salmon and operates in all major salmon farming areas in the world. It is the largest salmon producer, harvesting around one-fifth of the salmon produced in Norway and about one-third of the total production in North America and the UK. Exposure to every major producing region insulate it from some of the regional risks (unfavorable environmental conditions, disease outbreaks). It is expected that per capita fish consumption is to increase on all continents, which would drive salmon prices further, while the natural entry barriers remain. We believe that Company’s strategy toward more value-added products (e.g. smoked salmon) will have favorable impact on the company’s profitability. In addition to strong business fundamentals Mowi this year topped The Coller FAIRR Protein Producer Index – a list that ranks the world’s 60 largest meat, dairy and fish producers for sustainability making it World’s most sustainable protein producer.

PORTFOLIO INVESTMENT DECISIONS

Disney (SELL)

For a few years in a row Disney was an under-performer in our US portfolio as investors were concerned about all the disruption in the media industry, cord-cutting and over-reliance on ESPN with falling sports viewership. Netflix was dominating the space, growing membership at eye-popping rates and producing content that caused a truly addiction-like binge-watching habit in many consumers. But we were always a believer in the company due to its top content library and an unparalleled ability to monetize it through its theme parks, cruises and merchandise. 2019 was the year when Disney finally broke out of the trading range – after acquiring Fox assets and reaching necessary scale. The company finally rolled out its Disney+ service that turned out to be a major success with nearly 40 million subscribers. Moreover, Disney released six movies that grossed above 1 billion at the global box office – Avengers Endgame, Lion King, Frozen 2, Toy Story, Captain Marvel and Aladdin – beating its own 2018 record. In fact, the company now accounts for nearly 40% of US box office after “marriage” with Fox, while closest competitor Warner Bros. hovers around 14%. Why did we sell it then? The main reason was that company took some large pile of debt to finance assets acquired from 21st Century Fox, with the quality of balance sheet falling below our threshold. But there was also another big question arising – how profitable this business would become with all the competition intensifying on behalf of major tech companies. Amazon and Apple are investing heavily in the space and as Theodore Sarandos, Netflix Chief Content Officer, pointed out during the last earnings call – content costs were up a whopping 30% for the last year alone. That would certainly have a meaningful effect on company’s profitability over the long-term. After disrupting the way we live, work and communicate, big tech is coming after Hollywood and, to get a proof of that, just watch the latest Ricky Gervais speech at the Golden Globes (link). (link).

Booking (HOLD)

Online travel is another sector that big tech is coming after. Last year Booking.com came under pressure as Alphabet rolled out its Google Hotels module that allows you to choose and book a property for your next vacation directly from search results. Expedia, the second-biggest player, lost almost third of its market cap after reporting disappointing quarterly results early November, marking a biggest one-day loss in stock’s trading history. And investors in Booking.com and TripAdvisor were surely also worried as their stocks dived 8% and 20% respectively. Why are we still convinced and company is among our top picks? Booking. com is mostly a European play, where industry is much more fragmented, unlike in the US, which is dominated by few major players like Marriott and Hyatt that are growing their direct to-consumer membership programs, cutting expenses for lead generation to traffic aggregates. These hotel chains are the ones to benefit the most from Google Hotels, as smaller chains and independent hotels have much more reliance on Booking.com partnership. The company is adding apartment and villa inventory to compete with Airbnb and building revenue streams from additional services as travelers are much more willing to spend on experiences during their stays. Additionally, Booking pays around $5 billion to Google for traffic acquisition costs (roughly equals to annual net profit), which they surely will reduce now to improve bottom line, as brand is already well known online, and concentrate on TV ads and other marketing activities. We think that this company is having unmatched scale in the industry and its client access and cash generation ability would make it one of the winners of 2020.

OUTLOOK: CENTRAL BANKS TO CONTINUE, NO ALTERNATIVE FOR STOCKS, AND STOCK SELECTION

Economic slowdown to encourage further easing by Central Banks

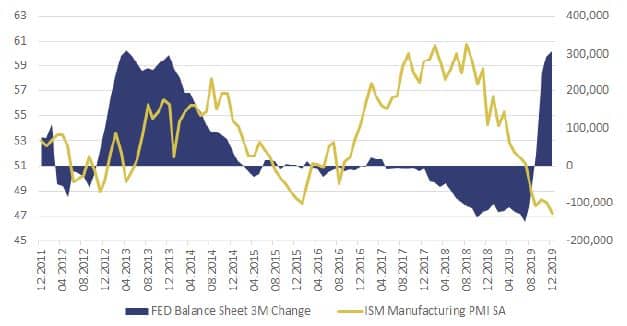

We are in the late cycle of economic expansion, witnessing inevitable slowdown of the global economy – latest figures on manufacturing activity do not provide any reason for optimism. Worries about possible recession motivate Central banks to continue their stimulation policy and pump money into economy. According to Bloomberg, the combined monthly balance sheet expansion of ECB, FRS and Bank of Japan is at the highest level since 2017. The interest rates were also cut in 2019 and being now on a very low level are not forecasted to increase in 2020. Loose monetary policy seems to be the only efficiently working tool nowadays and is used across the globe to sustain economies, while keeping inflation rates tamed. Central banks’ efforts to revitalize economic growth provided a great support to the equity markets last year and are poised to do so also next year as the national economies most likely will continue to struggle.

Fig.1 FRS reacting to the slowdown in manufacturing activity (PMI)

Source: Hérens Quality AM, MSCI, Reuters

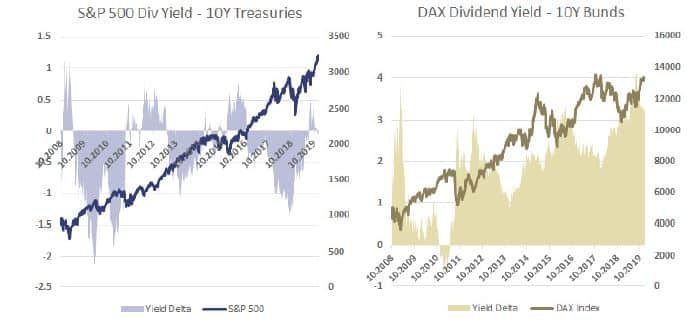

Bonds are not an option

Given current interest rates environment, there is hardly any incentives to invest in investment grade bonds, which would not contribute to capital appreciation now. Growing risk appetite of the investors and increase in demand for stocks is partly driven by more clarity on Brexit deal and relative calmness around Sino-US trade wars. Stocks remain more attractive than bonds when comparing earnings yield and the treasury rate – the situation we have been observing for a rather long time now. Additionally, dividend yields look very appealing in comparison with the bond yields – in Europe, the degree of appeal is at the highest level since 2011 (ave. dividend yield is 3% now). Even in the US, where payouts and yields are lower and interest rate is higher, current average dividend yield (1.8%) exceeds that of treasuries. So, the risk appetite is growing and the stakes are rising, leading to higher popularity of equity investing. Peer to-peer investments, especially as alternative to bonds, is another option being considered by capital holders as it offers decent return rates and lower volatility as compared to the stock markets.

Fig.2 Dividend yields and 10Y Treasury yield delta vs. stock market performance

Source: Hérens Quality AM, MSCI, Reuters

Trends in stock investing: FCF is the king, more debt, AI data in stock selection

We expect positive sentiment to prevail on the equity markets, helped by the current market situation with loose monetary policy and clarity on trade deal and Brexit. However, far not every stock is destined to perform well just because of the favorable monetary policies. We believe there will be a significant discrepancy in performance of good and bad companies. Nowadays, a talented PR campaign is no longer a sufficient tool for the company in maintaining own appeal. Investors seek real growth not just in sales, but also in cash flows, which would allow management to make further investments into the future. Low interest rates not only extend life of zombie companies, but also stimulate businesses to take more debt, therefore increasing returns on equity capital and leading to riskier balance sheets. Thus now, more than ever, the assessment of company’s quality should primarily focus on the consistency of cash flow generation, and to a lesser extent on the debt levels. Issue of the elevated financial leverage is no longer as critical as it was before, given that the debt servicing costs now are low. Satellite data, Glassdoor reviews, management mood during earnings calls, job ads – these AI-analyzed data firmly come into the scope of criteria investors check before making an investment decision. AI analysis is being organically weaved into the traditional fundamental analysis, enriching it and offering higher chance to earn alpha returns. Take Pandora as an example. Already in mid- December, website traffic showed new Harry Potter collection was a major success in the UK (12% of revenue), Italy (11%) and Australia (4%), quickly running out of stock globally shortly after launch despite being excluded from Black Friday deals. Therefore, for us it was not really a great surprise when on January 6th company released better than-expected Q4’19 organic growth figures.